31+ Total interest paid on mortgage

The total interest paid over the life of the loan will be about 116533. Mortgage interest deductions are considered itemized.

31 Money Receipt Templates Doc Pdf Receipt Template Book Review Template Book Reviews For Kids

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

. Here are the current average rates for the week of August 31 2022 according to Bankrates weekly survey of institutions. Should you withhold more than 30 of the total amount paid. You can withdraw the total balance and interest earned from this no.

936 Home Mortgage Interest Deduction for more information. Set us as your home page and never miss the news that matters to you. An SL or thrift is a financial institution that accepts savings deposits and makes mortgage car and other personal loans to individual members a cooperative venture known in.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. A tour of Mackinac Island Chicago vacation spot named Best Island in Continental US. 4 time and savings deposits certificates of deposit and money market accounts.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. A copy of this form will also be sent to the IRS. 15-Year Mortgage Interest Rates The average interest rate on the 15-year fixed mortgage is 523.

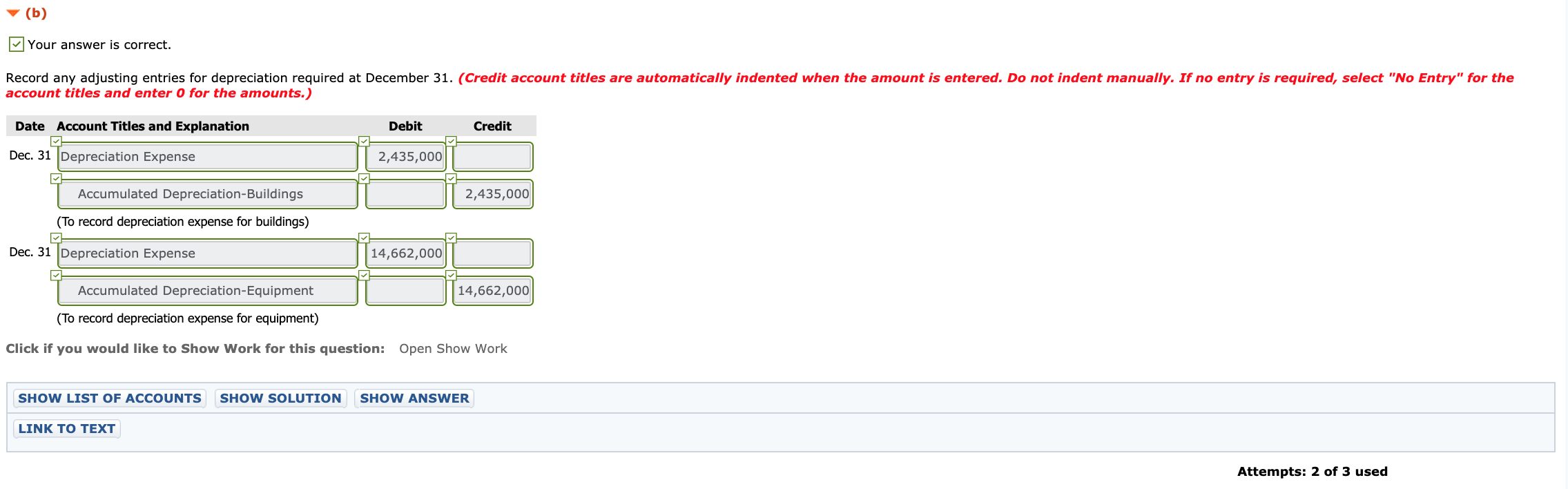

More Health News Business News More Business News. The statement for each year should be sent to you by January 31 of the following year. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

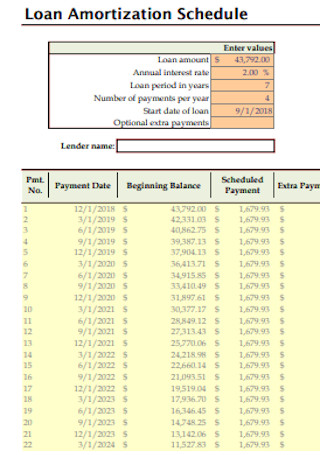

Remember a mortgage is paid in arrears ie. The savings and loan crisis of the 1980s and 1990s commonly dubbed the SL crisis was the failure of 1043 out of the 3234 savings and loan associations SLs in the United States from 1986 to 1995. Simply add the scheduled payment B10 and the extra payment C10 for the current period.

RBI hikes repo rate by 50 basis points to 490. And paid or incurred after December 31 2020 and before January 1 2023. Sources or the taxable amount can be determined or 1 year from the date the amount is placed in.

1 the gross value of owner-occupied housing. IRS Publication 936. A 20-minute ferry ride gets you to Mackinac Island.

Mortgage loan basics Basic concepts and legal regulation. Total assets are defined as the sum of. The principal payoff letter will have an exact amount to account for everything.

The loan is repayable by monthly instalments for 10 years from 1122020 onwards. Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more likely to exceed. 3 cash and demand deposits.

If the schedule payment for a given period is greater than zero return a smaller of the two values. On 1112020 he borrowed a mortgage loan from a bank to pay for part of the purchase price. Get a little money back from the extra interest you paid.

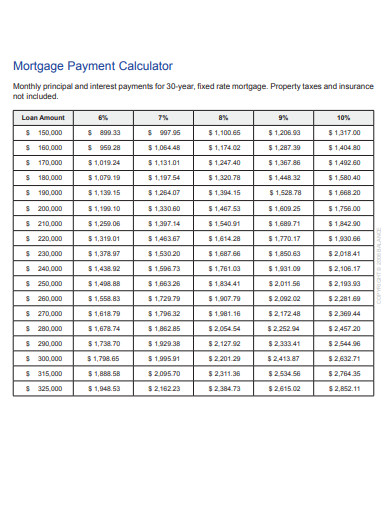

Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. 2 other real estate owned by the household. The statement will show the total interest you paid during the year any mortgage insurance premiums you paid and if you purchased a principal residence during the year it will also show the points paid.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. You may elect to hold 30 of the payment in escrow until the earlier of the date that the amount of income from US. B only where and as necessary in the interest of justice may set aside the proceeding or a step document or order in the proceeding in whole or in part.

Scheduled payment minus interest B10-F10 or the remaining balance G9. But note if payments on a debt are paid as frequently as the compounding and the payment covers the interest due then even if the terms of the loan call for compounding there will be no impact on the total amount paid because at no point will there. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

On widely expected lines the Reserve Bank of India RBI on June 8 2022 increased its short term lending rate the repo rate by 50 basis points as the countrys apex bank tries to bring down inflation from an eight-year-high levelThe six-member monetary policy committee voted unanimously in favour of the rate hike. Simple interest is the interest calculation method that is least beneficial to savers and the most beneficial to borrowers. Additionally for tax years prior to 2018 the interest paid on up to 100000 of home equity debt was also deductible raising the previous total to 1100000.

A Definitions--In this section-- 1 the term covered loan means a loan guaranteed under paragraph 36 of section 7a of the Small Business Act 15 USC. The total time you ordinarily spend in each place. Deposit interest paid to certain nonresident alien individuals.

Facts On 192020 Mr A purchased from the developer a property which was under construction. See how to get the lowest mortgage rates with Guaranteed Rate by viewing interest rates for all our home loans. 2 The court shall not set aside an originating process on the ground that the proceeding should have been commenced by an originating process other.

The mortgage payment for June is paid on July 1 etc. Mortgage loan interest paid during construction period. IFERRORB10C10 Principal E10.

6 the cash surrender value of life. 636a as added by section 1102. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

Total Payment D10. 2 the term covered mortgage obligation means any indebtedness or debt instrument incurred in the ordinary course of business that-- A is a. The home mortgage interest deduction currently allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Loans with deductible interest typically include. The payoff statement will always have you paying a bit more to ensure a complete payoff.

The amount paid in interest begins to stack up and can become. The Troubled Asset Relief Program TARP is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George BushIt was a component of the governments measures in 2009 to address the subprime mortgage crisis. Compare mortgage interest rates today.

5 government bonds corporate bonds foreign bonds and other financial securities.

Free Printable Promissory Note Promissory Note Notes Template Templates Printable Free

Project Budget Proposal Template Proposal Templates Free Proposal Template Business Proposal Template

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

31 Money Receipt Templates Doc Pdf Free Premium Templates

Pin On Savings Side Gigs Financial Success

Nnznar94jqnprm

Printable Blank Pdf Time Card Time Sheets Timesheets Templates Templates Printable Free Template Printable Timesheet Template

8 Sample Loan Amortization Schedules In Pdf Ms Word

Payment Plan Agreement Template 21 Free Word Pdf Documents Download Free Payment Agreement Contract Template Lettering

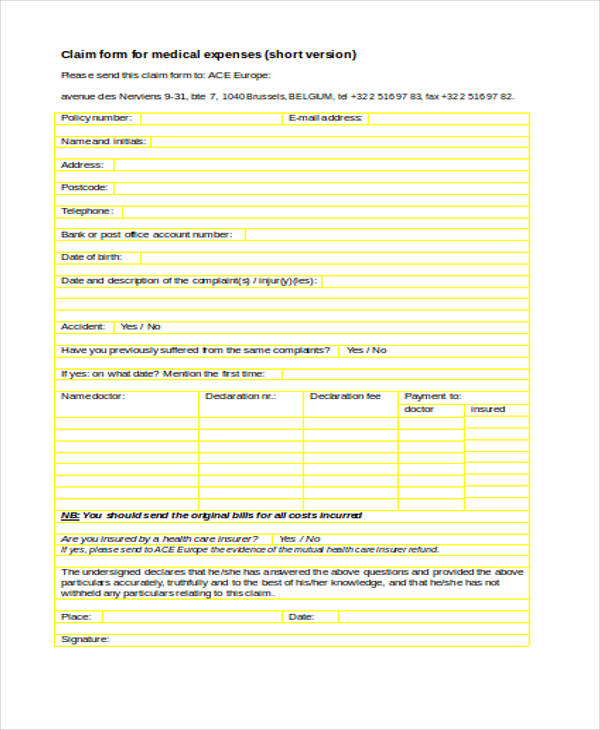

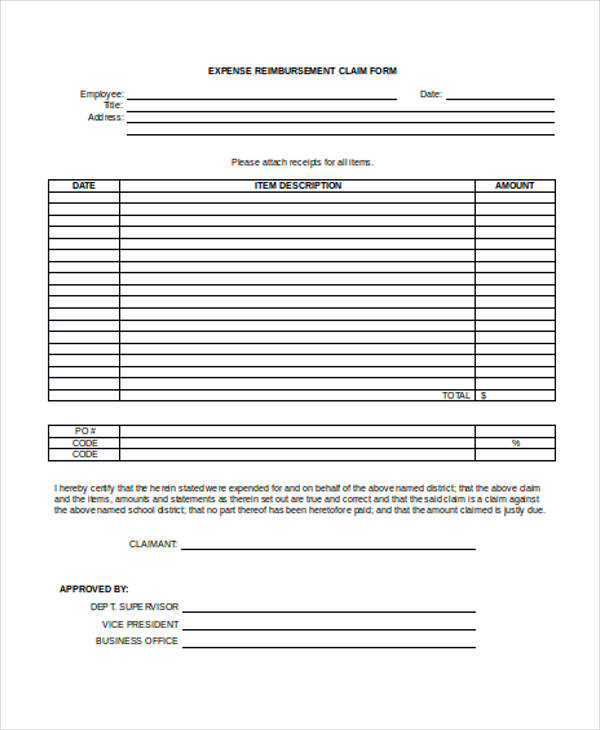

Free 31 Claim Forms In Ms Word

Printable Blank Pdf Time Card Time Sheets Timesheets Templates Templates Printable Free Template Printable Timesheet Template

Pin On Bible Study

Deployment Checklist Deployment Checklist Army Wife Life

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Solved Question 1 At January 1 2022 Crane Company Reported Chegg Com

![]()

Should You Skip Mortgage Payments If You Don T Have To

Free 31 Claim Forms In Ms Word